BOSTON, May 17, 2022 (GLOBE NEWSWIRE) — via InvestorWire — AmeriCann Inc. (ACAN), a cannabis company that develops state-of-the-art cultivation, product manufacturing and distribution facilities, released financial and operational results for its fiscal quarter ending March 31, 2022.

Financial Overview

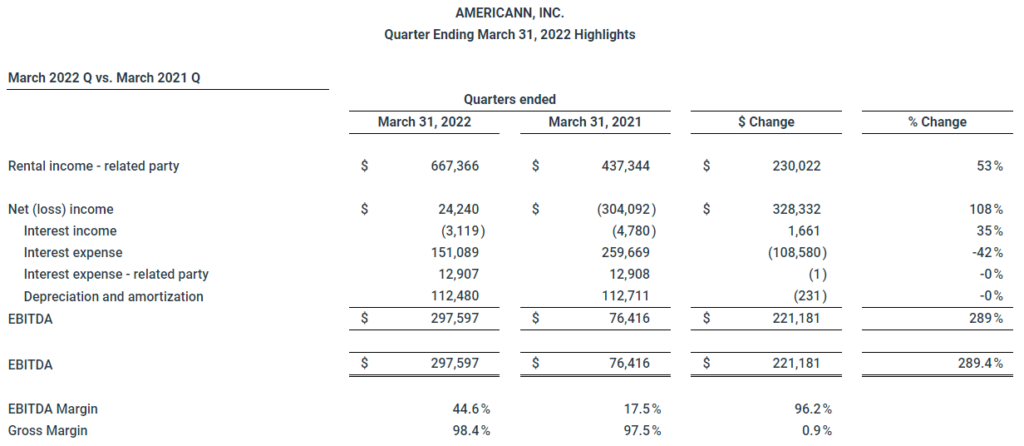

The Company achieved a significant increase in year-over-year quarterly revenue, culminating in positive net income for the quarter ending March 2022. Revenue from operations increased over 52% for the quarter ended March 2022 relative to the quarter ended March 2021, an increase of $230,021. Quarterly gross margins were 98%.

AmeriCann also announced that revenue for April 2022 set an all-time monthly record for the Company.

The increase in financial performance is attributable to greater revenue received from products produced and manufactured at Building 1, the Company’s initial building at its Massachusetts Cannabis Center development in Freetown, Massachusetts.

Building 1 is a 30,000-square-foot cultivation greenhouse and processing facility that utilizes AmeriCann’s proprietary “Cannopy” cultivation system. Building 1 is fully occupied by Bask Inc., an existing Massachusetts licensed vertically integrated cannabis operator.

AmeriCann receives base rent and a Revenue Participation Fee of 15% of all gross monthly sales of cannabis, cannabis-infused products and non-cannabis products produced at the Massachusetts Cannabis Center. As operations commenced and accelerated at Building 1, AmeriCann established many milestones for its financial performance.

A summary of operational highlights included the following:

- AmeriCann’s Operating Revenue from Building 1 increased over 52% from the quarter ended March 31, 2021, to the quarter ending March 31, 2022.

- The Company achieved positive Adjusted EBITDA for the quarter of $297,597, an increase of 289% over the quarter ending March 2021. Adjusted Operating EBITDA margins for the quarter were 44.6%.

- The manufacturing of cannabis infused products, including the 1906 branded “Drops,” Howl’s Tincture, and Harpoon Extracts, have increased dramatically at the Massachusetts Cannabis Center. Sales of manufactured infused products are expected to be even stronger once the anticipated increase of production and sales for 1906 “Drops” are realized.

- For the months of December, January and February the 1906 branded “Drops” were the top selling edible product in the Massachusetts market. Howl’s Tincture was the top selling brand in the Tincture Category.

- AmeriCann’s tenant, Bask, Inc. added adult-use retail sales in February of 2021 which has increased revenue from products produced at the Massachusetts Cannabis Center.

- In February 2022, revenue from the Massachusetts cannabis market was $139.6 million which was 40% greater than February 2021.

- For the 2021 calendar year, revenue for the Massachusetts cannabis market was $1.62 billion, 75% more than 2020 revenue. Experts believe the market will exceed $1.8 billion annually.

- Total Massachusetts cannabis sales have recently exceeded $3 billion since the inception of the Commonwealth’s regulated cannabis program.

See definitions of non-GAAP measures later in this release.

Management Commentary

“The success we have achieved with Building 1 is a testament to the quality of consistent products being produced for patients and consumers,” said AmeriCann CEO and President Tim Keogh. “The increased revenue, margins and profits we have achieved validates our vision for the Massachusetts Cannabis Center and our expansion plans.

AmeriCann is in the final design phase of the expansion of its MCC development in Freetown, Massachusetts. AmeriCann has secured cultivation and manufacturing licenses for Building 2 – the next phase of the Massachusetts Cannabis Center. Building 2 calls for approximately 400,000 additional square feet of cannabis cultivation, manufacturing and distribution infrastructure.

About AmeriCann

AmeriCann (OTCQB:ACAN) develops and leases cannabis cultivation, processing and product manufacturing facilities.

AmeriCann uses greenhouse technology which is superior to the current industry standard of growing cannabis in warehouse facilities under artificial lights. According to industry experts, by capturing natural sunlight, greenhouses use 25% fewer lights, and utility bills are up to 75% less than in typical warehouse cultivation facilities. As such, AmeriCann’s Cannopy System enables cannabis to be produced with a greatly reduced carbon footprint, making the final product less expensive. Additionally, greenhouse construction costs are nearly half of warehouse construction costs.

AmeriCann is also designing GMP-Certified cannabis extraction and product manufacturing infrastructure. AmeriCann has secured licenses to produce cannabis-infused products including beverages, edibles, topicals and concentrates. AmeriCann plans to operate a Marijuana Product Manufacturing business at the Massachusetts Cannabis Center.

To learn more about the Massachusetts Cannabis Center click HERE to watch a short video.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (which Sections were adopted as part of the Private Securities Litigation Reform Act of 1995). Statements preceded by, followed by or that otherwise include the words “believe,” “anticipate,” “estimate,” “expect,” “intend,” “plan,” “project,” “prospects,” “outlook,” and similar words or expressions, or future or conditional verbs such as “will,” “should,” “would,” “may,” and “could” are generally forward-looking in nature and not historical facts. These forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the Company’s actual results, performance or achievements to be materially different from any anticipated results, performance or achievements. The Company disclaims any intention to, and undertakes no obligation to, revise any forward-looking statements, whether as a result of new information, a future event, or otherwise.

About Non-GAAP Financial Measures

The Company uses “adjusted EBITDA,” as a non-GAAP financial measure to evaluate financial performance such as period-to-period comparisons. This non-GAAP measure is not defined under U.S. GAAP and should be considered in addition to, not as a substitute for, indicators of financial performance reported in accordance with U.S. GAAP. The Company may use non-GAAP measures that are not comparable to measures with similar titles reported by other companies. Also, in the future, the Company may disclose different non-GAAP financial measures in order to help investors more meaningfully evaluate and compare the Company’s future results of operations to its previously reported results. The Company encourages investors to review its financial statements and publicly-filed reports in their entirety and not rely on any single financial measure. The section titled “Reconciliation of Non-GAAP Financial Measures” includes a detailed description of this measure as well as a reconciliation to its most similar U.S. GAAP measure.

Reconciliation of Non-GAAP Financial Measures

The Company defines adjusted EBITDA as net income adjusted to exclude the impact of interest expense, interest income, income taxes, depreciation, depletion and amortization, stock based compensation, impairment, and the plus or minus change in fair value of derivative assets or liabilities. The Company believes adjusted EBITDA is relevant because it is a measure of cash flow available to fund capital expenditures and service debt and is a metric used by some industry analysts to provide a comparison of its results with its peers. The following table presents a reconciliation of the Company’s non-GAAP financial measures to the nearest GAAP measure.

Contact Information:

Corporate:

[email protected]

www.americann.co@ACANinfo on Twitter

@AmeriCann on Facebook

@AmeriCannInc on Instagram

AmeriCann, Inc on LinkedIn

Corporate Communications:

InvestorBrandNetwork (IBN)

Los Angeles, California

www.InvestorBrandNetwork.com

310.299.1717 Office

[email protected]

A photo accompanying this announcement is available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/9591d455-fd3f-43ca-8022-80bed35f189c