Appia Rare Earths & Uranium (CSE: API) (OTCQX: APAAF) will already be familiar to many readers via a previous full-length feature article [https://ibn.fm/x9U2v].

In that piece, we labeled the previous spectacular drill results from Appia’s PCH Ionic Adsorption Clays Project “a game-changer”.

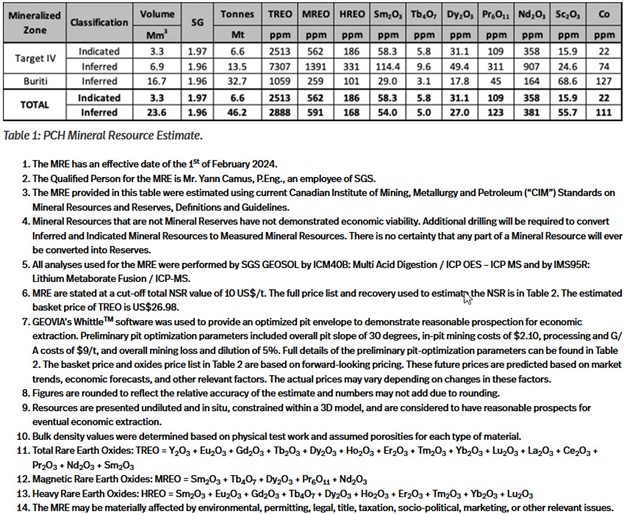

Since that time, Appia has released a maiden mineral resource estimate (“MRE”) for the PCH Project based upon that drilling data. The impressive numbers for this REE deposit fully justify our original assessment.

While the headline is a lot to absorb, the headline numbers are, once again, spectacular.

- A 6.6 million tonne Indicated REE resource, grading at 2,513 ppm total rare earths oxide (“TREO”)

- A 46.2 million tonne Inferred resource, grading at 2,888 ppm TREO

The full technical report [https://ibn.fm/vWJZz] on this maiden resource estimate has just been released on April 16, 2024 [https://ibn.fm/w02k1].

With rare earths mining just emerging in the Western world, even many mining investors may not be able to put these grades into context. Appia’s senior management shared their insights with investors.

CEO Tom Drivas presented the Big Picture for investors.

With an estimated 6.6 million tonnes of high-grade mineralization in the indicated category and 46.2 million tonnes of high-grade mineralization in the inferred category, and with some of the highest TREO grades in the world, we are well on our way to establishing the company as a leader not only in Brazil, but around the globe.

These world-class grades are hosted in “weathered material” in a near-surface ionic adsorption clays REE deposit. We’ll explain the significance of this at greater length later in the article.

Appia’s President, Stephen Burega, shone a spotlight on some of the important details from this news.

Today’s announcement is very important to the company and our shareholders, and this is only the beginning for this amazing project. We have delineated a combined resource of 52.8 million tonnes of high-grade mineralization in an area of only 483 hectares across both target zones. Appia is continuing its exploratory auger drilling program to test multiple new target areas across the PCH project which covers over 40,000 hectares.

Literally just scratching the surface of this huge REE project. And as we previously noted to readers, mining exploration in an ionic adsorption clays formation is extremely economical.

The drilling data for this initial resource estimate was taken from the drill results of 138 RC drillholes and 1 Diamond drillhole [https://ibn.fm/fMELn]. The total cost of the campaign to date is only ~USD$1 million.

What is the potential for resource expansion with respect to this world-class REE resource?

Mineralization remains open at depth as well as being open laterally. Translation: there is robust potential for REE resource expansion at the PCH Project just with respect to the REE resource from the Target IV and Buriti Zones.

This is a huge land package of >40,000 hectares, and several other high-priority targets have already been identified. Much of the PCH geology exhibits the potential for additional (highly-coveted) ionic clays deposits.

For even greater understanding here, IBN reached out to additional members from Appia’s management team.

A truism in mining is that world-class projects attract world-class teams. Appia boasts an abundance of expertise in assessing the quality of this REE asset.

As we indicated earlier, the PCH REE resource is comprised mostly of weathered material, versus the primary mineralization in which most REE mineralization is hosted.

One person with a particular appreciation for this important distinction is renowned REE expert, Jack Lifton. A noted consultant, author and lecturer in the mining industry, Lifton has been added to Appia’s management team as a REE & Critical Minerals Advisor.

We asked Lifton to explain the significance of high-grade REE mineralization hosted in the weathered material of an ionic adsorption clays formation versus primary mineralization.

Ionic adsorption clays are uniquely important formations from which essentially all of the demand for the higher atomic numbered rare earths, also known as heavy rare earths, are recovered.

Unlike hard rock deposits of rare earths, which require blasting, excavating, crushing, grinding, flotation and acid leaching to extract the desired elements, IACs require only an extraction wash with a water solution of ammonium sulphate, A common agricultural fertilizer. This can often be done in place (in situ). This technique is among the lowest cost mineral extraction regimens known in mining today.

Most IACs contain little or no radioactive companion metals to the rare earths.

Appia’s Brazilian discoveries are not only massive in their total tonnage, but are the richest concentrations of heavy rare earths, as well as of the light magnet rare earths, neodymium and praseodymium, in an ionic adsorption clay that I have ever seen.

“The richest concentrations” of REE in an ionic adsorption clay resource. That’s high praise, coming from a world-renowned REE expert.

In these ionic clays, rare earths mineralization is in the form of free-standing particles, almost like an alluvial formation. This is why only minimal processing is required.

With the REE in these ionic adsorption clays formations typically exhibiting much lower radioactivity, this further simplifies the production process.

This implies significant savings in both the capital costs of a (potential) mining operation as well as operating costs.

The weathered material in which this near-surface REE deposit is hosted also implies a faster timeline for mine construction and a quicker production process. This translates into additional savings in both capital costs and operating costs.

When CEO Drivas referred to the PCH Project as having “some of the highest TREO grades in the world”, this is with respect to a REE ionic clays deposit. Higher TREO grades can be found with respect to REE hosted in less-desirable geological formations.

However, demonstrating the importance of this type of ionic adsorption clay geology for REE production, most of the world’s supply of rare earths (predominately from China) are also hosted in similar geological formations.

When you combine the world-class grades and mining-friendly geology of the PCH Ionic Adsorption Clay Project with the enormous potential for resource expansion investors begin to understand the excitement that is percolating within Appia’s management team.

It’s more than just REE grades. It’s also the composition of the PCH resource, as previously stressed by Jack Lifton.

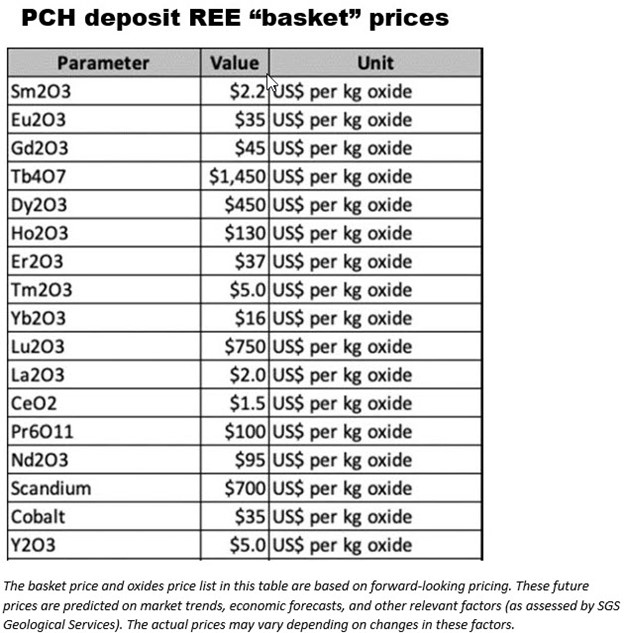

The PCH Project maiden resource is rich in the rare earths that are most heavily in demand today: praseodymium (Pr), neodymium (Nd), terbium (Tb), and dysprosium (Dy).

This is shown in the “basket prices” of the REE contained in the deposit that was also released with the PCH Project resource estimate.

With stellar grades hosting a very desirable mix of REE, in geology that is optimal for REE mineralization, the question that will be on the mind of many investors is what is next for Appia in developing this world-class asset?

For guidance here, we turned to another one of the experts from Appia’s management team. Don Hains (P.Geo) is a Consulting Geologist and REE Critical Minerals Advisor for Appia.

However, Hains expertise goes beyond his 40+ year career as a geologist. He also has an intimate understanding of the processing and markets for these industrial minerals – particularly REE. Perhaps no one is more familiar with the geology of the huge land package on which the PCH Project is situated than Hains.

Target IV and the Buriti Zone (which hosts the existing REE resource) is open both laterally and at depth. Other high-priority targets on the property also exhibit similar geology to the defined REE deposit.

“The drill results to date are very encouraging. Seeing consistent depths and grade of ionic clay mineralization across Target IV and Buriti confirms the initial thesis that the deposit has great potential. The geology and mineralization seen at Target IV and Buriti appears to extend to other areas of the PCH project, indicating great exploration potential within the ionic clay horizon.”

With the operational focus remaining on Target IV and the Buriti Zone, at least at present, this opens up interesting possibilities with respect to both upcoming drill results and Project development.

Rare earths are essential in powering most of today’s leading technologies, from electric vehicles to smartphones. As we indicated in our first Appia feature article, the supply of REE from China (which accounts for roughly 90% of the market) is increasingly in doubt.

This means that the development of Western-based rare earths projects is essential for our own future economic development.

For investors interested in capitalizing on this important economic trend, Appia Rare Earths & Uranium provides a world-class opportunity – still at an early stage of development.

Appia Rare Earths & Uranium corporate presentation.

For more information, visit the company’s website at www.AppiaREU.com.

NOTE TO INVESTORS: The latest news and updates relating to APAAF are available in the company’s newsroom at https://ibn.fm/APAAF

About InvestorWire

InvestorWire (“IW”) is a specialized communications platform with a focus on advanced wire-grade press release syndication for private and public companies and the investment community. It is one of 60+ brands within the Dynamic Brand Portfolio @ IBN that delivers: (1) access to a vast network of wire solutions via InvestorWire to efficiently and effectively reach a myriad of target markets, demographics and diverse industries; (2) article and editorial syndication to 5,000+ outlets; (3) enhanced press release enhancement to ensure maximum impact; (4) social media distribution via IBN to millions of social media followers; and (5) a full array of tailored corporate communications solutions. With broad reach and a seasoned team of contributing journalists and writers, IW is uniquely positioned to best serve private and public companies that want to reach a wide audience of investors, influencers, consumers, journalists and the general public. By cutting through the overload of information in today’s market, IW brings its clients unparalleled recognition and brand awareness. IW is where breaking news, insightful content and actionable information converge.

For more information, please visit https://www.InvestorWire.com

Please see full terms of use and disclaimers on the InvestorWire website applicable to all content provided by IW, wherever published or re-published: https://www.InvestorWire.com/Disclaimer

InvestorWire

Los Angeles, CA

www.InvestorWire.com

310.299.1717 Office

[email protected]

InvestorWire is powered by IBN